santa clara property tax rate 2021

Santa Clara Co Local Tax Sl 1. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of.

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Santa clara Tax jurisdiction breakdown for 2022.

. County of Santa Clara. Proposition 13 1978 limits the property tax rate to one percent of the propertys assessed value plus the rate necessary to fund local voter-approved debt. 12345678 Enter Account Number.

Method to calculate Santa Clara County sales tax in 2021. The Santa Clara sales tax has been changed within the last year. What is the sales tax rate in Santa Clara County.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Enter Property Address this is not your billing address. City Rate County.

It also limits increases on assessed values to two percent per year on properties with no change of ownership or no new construction. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. Next to city indicates incorporated city.

Tax Rate Book Archive. Santa Barbara campus rate. Method to calculate Santa Clara sales tax in 2021.

The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate. Ultimate Santa Clara Real Property Tax Guide for 2021.

FY2019-20 PDF 198 MB. Santa Clara County Assessors Mission Statement. Low Value Ordinance The Assessor introduced the low valueminimum assessment ordinance adopted by the Board of Supervisors which provides property tax relief to thousands of small.

California City and County Sales and Use Tax Rates Effective 1012021 through 12312021 1 Page Note. Property Tax Rate Book Property Tax Rate Book. It also limits property tax increases to a.

COUNTYWIDE 1 PROPERTY TAX DISTRIBUTION FY2020-21. Compilation of Tax Rates and Information. As mentioned above some.

Or set property tax rates. Property taxes are levied on land improvements and business personal property. 1788 rows Santa Clara.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. It was raised 0125 from 9 to 9125 in July 2021 and raised 0125 from 9 to 9125 in July 2021. This is the total of state and county sales tax rates.

The minimum combined 2022 sales tax rate for Santa Clara County California is. FY2020-21 PDF 150 MB. It limits the property tax rate to 1 percent of assessed value ad valorem property tax plus the rate necessary to fund local voter-appr oved debt.

Santa Clara County District Tax Sp 188. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. For example a 1000000 home has a transfer tax of 1100.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. The median annual property tax payment in Santa Clara County is 6650. Enter Assessment Number.

As we all know there are different sales tax rates from state to city to your area and everything combined is the. The assessments allow the County of Santa Clara to collect and allocate property tax revenue which supports. Click here to find other.

County transfer tax is typically 110 for every thousand dollars of the purchase price.

Pin By Nathaniel Key On Real Estate In 2021 Boise City Sunnyvale Housing Market

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

4 Ways To Win A Bidding War In 2021 War Dreaming Of You Win

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

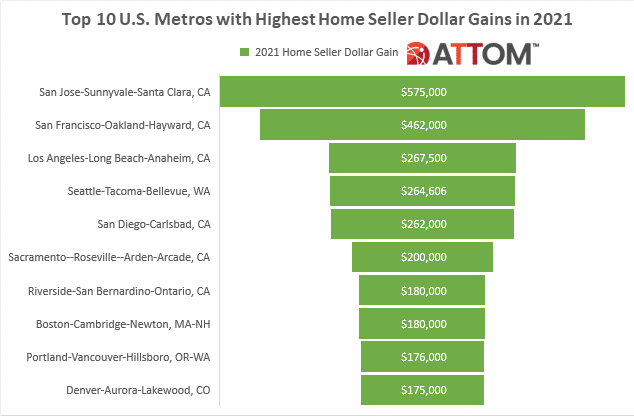

Top 10 U S Metros With Highest Home Seller Profits In 2021 Attom

Income Tax Deadline Extended But Property Tax Deadline Stays The Same April 12 County Of San Bernardino Countywire

Santa Clara County Ca Property Tax Calculator Smartasset

Property Taxes Department Of Tax And Collections County Of Santa Clara

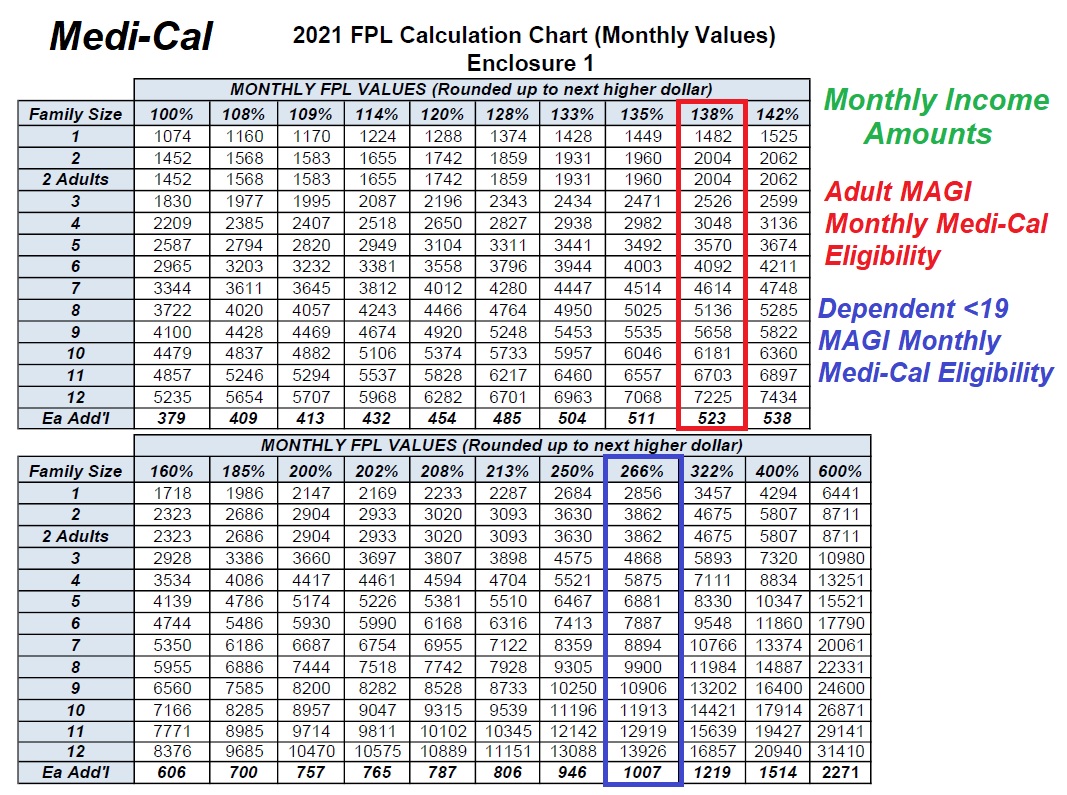

2021 Medi Cal Income Amounts Modest Increase Fpl

Cannabis Cultivation Tax Rates To Increase On January 1 2022 Law Offices Of Omar Figueroa

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara

Homeowner Equity Insights Corelogic

Pin By Robert Paul On My Style Installing Insulation Fiberglass Batts Home Builders